Making real estate investments can be a great way to secure your financial future. However, it’s essential to calculate the Return on Investment (ROI) of each property you’re considering. By doing so, you can determine which property is the best fit for you and your goals.

Calculating ROI provides real estate investors an easy way to screen and compare potential investment properties. Return on investment is calculated using a simple formula that looks only at gains and the initial investment. The formula is simply the gains divided by the investment and results in a percentage gain. For instance, a gain of $1,000 on a $10,000 investment provides a 10% ROI.

While the simplicity of the ROI formula lets you quickly investigate prospective investments, it does not tell the whole picture. The formula includes no notion of time horizon, nor does it provide insight into cash flow.

In this blog post, we will walk you through the process of determining ROI and show you how to use it to make informed decisions about your investments.

What Is Real Estate ROI And Why Is It Important To Calculate?

ROI in real estate is the return you earn on an investment property after accounting for all income and expenses divided by how much you invested in the property. By calculating real estate ROI, you can see how much profit you’re making on a property and compare it to other investments.

It’s important to calculate real estate ROI because it helps you make informed decisions about your investments.

For example, let’s say you’re considering two properties. Property A has a higher purchase price but is expected to generate more rental income and appreciate at a faster rate than property B. However, property B has a lower purchase price and is expected to generate less rental income but appreciate more slowly.

By calculating real estate ROI, you can compare these two properties and see which one is the better investment.

This comparison works regardless of the investment; it can be used for a single-family home or for apartment complexes.

You can also compare the ROI of potential investment properties with other types of investments like stocks or bonds. For instance, the average annualized return of the S&P 500 is just over 10%. If you can find a property with a higher ROI than that, you would likely be better off in the long-term by buying the property.

How To Calculate ROI On An Rental Property In 6 Easy Steps

Calculating the ROI of a real estate investment is straightforward as long as you know certain information regarding the purchase price and expected income and expenses. Once you know this information, just plug it into the formula or follow these steps.

1. Calculate The Initial Investment

The first step in calculating return on investment is determining your investment’s purchase price. This includes the cost of the property itself and any associated closing costs. You should also include any money you spent upfront for repairs.

2. Determine The Time Horizon

ROI can be calculated on any time horizon. You can choose to calculate the return on investment for 1, 5, 10, 20, or any other number of years. The longer the time window, the less accurate the calculation will be because it’s difficult to project into the future. However, the calculation can give you a rough idea of how a rental property might perform over time.

3. Calculate The Net Operating Income

To do so, you’ll need to estimate the monthly rent you anticipate receiving and multiply it by 12 (for a yearly total). Next, you’ll need to subtract your operating expenses and expected vacancy rate from this figure. This will give you your net operating income (NOI). Add the NOI for each year in your time window.

4. Subtract Debt Service

Subtract all debt service such as mortgage payments from the total NOI to get the total cash flow. This includes both principal and interest payments.

5. Determine The Future Property Value And Equity

This step can be quite difficult since you can’t know the future value. But you can estimate it based on the average appreciation rate. SFGate estimates home prices appreciate by 3.5 to 3.8 percent for a single-family home. Determining the future value of multifamily real estate is done using the income approach. Subtract the future loan balance (you can use any number of online loan amortization calculators to do this) from the future property value to get the equity.

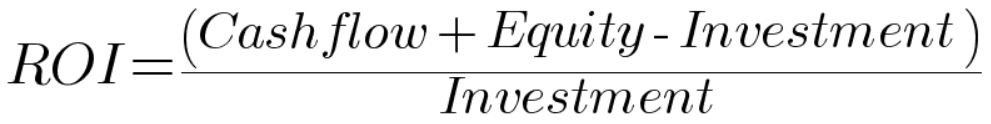

6. Determine The Return On Investment

Finally, add the total cash flow and equity and subtract the initial investment. Then divide this number by the initial investment. Multiply this number by 100 to get the ROI expressed as a percentage.

ROI Formula

ROI = The rental property’s ROI (Return On Investment)

Cash flow = The cash flow for all years in the calculation

Equity = The future expected equity in the property

Investment = The total investment in the property at the time of purchase

Factors That Affect Rental Property ROI

Now that we understand the return on investment formula and the steps to calculating ROI, let’s take a look at some factors that impact ROI. These all play an important role in the formula and we’ll dive into what effect each factor has.

Amount Invested

The initial amount invested in a rental property includes any down payment, closing costs, and capital expenses such as repairs when you purchase the property. It’s the amount of money you invest out of pocket.

One way to increase the ROI is to use leverage through a loan instead of a cash purchase of a rental property. While this will reduce your monthly cash flow, the gain in equity over time represents a higher percentage of your initial investment. In other words, leverage lets you trade cash now for more value later.

Rental Income

The monthly rental income you receive is a primary component of the cash flow from your rental property. It dictates how much free cash you can receive each month.

Higher cash flow from a rental property increases the ROI because it is cash directly generated and returned from the property.

It is important for real estate investors to maintain positive annual cash flow, not only to increase the property’s ROI but also to ensure there is enough money to pay for expenses and have some leftover.

Operating Expenses

Operating expenses such as property management, utilities, and more reduce the ROI because they offset the rental income and reduce your cash flow.

Many of these expenses are predictable, but a real estate investor should closely monitor unexpected expenses like repair and maintenance costs. These operating costs can add up quickly and significantly reduce the ROI.

Capital Expenses

When you purchase a property, you may need to do some work repairing or remodeling. You might also have to replace appliances. All of these costs add to your total cash invested. If you have to put a significant amount of work into the property, you’ll need to generate a significantly greater cash flow to offset the initial investment to reach a higher ROI.

Debt Service

You’ll likely use a mortgage or other loan to purchase a rental property. Cash transactions aren’t very common in real estate investing. The debt service, or mortgage payments, have 2 parts; principal paydown and interest payment.

Principal paydown goes directly back to you by lowering the loan balance while interest payments are an expense. Depending on the interest rate of the loan, this can eat up more or less of your net operating income.

A mortgage payment will reduce your annual cash flows, but adds equity through the principal paydown.

Equity

The amount of equity you have in your rental property changes over time through paying back any money borrowed and through changes in property value.

Increasing equity increases the ROI, but does not affect cash on cash return. Unfortunately, equity does not pay you until you sell or refinance the rental property.

Rental Property ROI Calculation Examples

Let’s take a look at some examples to see how different scenarios affect the return on investment. In each of these examples, we’ll assume the purchase of a $200,000 property with annual rent payments of $20,000 and annual operating expenses of $10,000. We’ll also assume you hold the rental property for 5 years and the property’s market value is $240,000 at the end of the 5 years.

Full Cash Transaction

In the first example, we will purchase the property in cash so the initial investment is $200,000. There is no loan so the yearly cash flow is simply annual rental income minus the annual operating expenses; $20,000 – $10,000 = $10,000.

The total cash flow for 5 years is $50,000 and you have $240,000 in equity since there is no loan in the deal.

In this example, the ROI is ($50,000 + $240,000 – $200,000) / $200,000 or roughly 45%

20% Down Payment

If instead of paying cash for the rental property, we used a mortgage with a 20% down payment and an interest rate of 4%, the numbers would look quite different.

In this case, we have a total investment of $40,000. We also have a monthly mortgage payment of $764. Over 5 years this will add up to $45,840 in debt service. At the end of the 5 years, we have also paid down the loan balance from $160,000 to $144,500. This means we have $95,500 in equity. We also have the same net rental property income of $50,000.

In this example, the ROI is ($50,000 – $45,840 + $95,500 – $40,000) / $40,000 or roughly 150%

That’s more than 3x the return of the cash transaction.

Why is this? Rental property investments typically earn a higher return through the use of leverage. Leverage allows us to have a larger property for less money upfront. In financed transactions, we get to keep all of the gains through increased equity just like if we had made a full cash purchase.

But this comes with a tradeoff. In the cash purchase example, we have a cash return of $50,000 while with a loan we only have a cash return of only $4,160.

Caveats Of The ROI Calculation For Rental Properties

While the simplicity of the ROI calculation gives investors an easy tool to project the performance of rental properties, it does have a number of caveats to be aware of.

- No time horizon is used in the calculation. A 20% ROI is completely different if it’s over 1 year or 10 years. You can calculate the average annual return by dividing the ROI by the duration in years. This average ROI, however, is a significant simplification of the returns.

- Doesn’t represent annual cash flow. While you can determine the annual cash flow from portions of the calculation, it’s better to calculate the cash-on-cash return to see how much monthly income you can expect to take out of the property. You can also use the more complex internal rate of return to compare similar properties on the basis of cash returns.

- Doesn’t account for tax benefits. Owning real property comes with a few great tax benefits including depreciation. This makes it more difficult to compare properties with other types of investments.

What Is A Good ROI In Real Estate Investing?

Typically, a good annual rate of return for a rental property is 10-12%. Some investors aim for a much higher annual return of 20% or more. The choice for your target rate of return is influenced by your investing goals and risk tolerance.

For example, if you’re looking for a safe investment with little downside risk, you might be happy with a lower return like single-digit returns.

But if you want more aggressive growth with a higher risk, you might want to look at properties with double-digit returns.

It’s also important to consider your investing goals. Are you looking for a high cash-on-cash return or long-term appreciation? Your goals will influence the rate of return.

Summary

Whether this is your first investment property or you manage a real estate portfolio, calculating the return on investment (ROI) of real estate investments helps you determine which property is the best fit. By evaluating ROI, an investor can compare investment opportunities and get a sense of future performance.

While there are more complex ways to measure the performance of rental property investments like internal rate of return and cash-on-cash return, ROI is the easiest to use and often a first step in evaluating rental properties.

What ROI do you aim for and what other metrics do you find important in your rental property investing journey?