Rent ledgers are a valuable and versatile tool for any rental property owner. With a rent ledger, you can quickly and easily show tenant payment status and estimate future rental income. Once you become familiar with the rent ledger, you will find it to be invaluable.

Filling out a rent ledger doesn’t have to be difficult. We will lay out the purpose for the rent ledger, what’s included, and how to fill one out. And we’ve included some best practices to help you avoid any problems.

If you are using a property manager, they will likely maintain a rent ledger for you. If they do, you should be able to request a copy at any time.

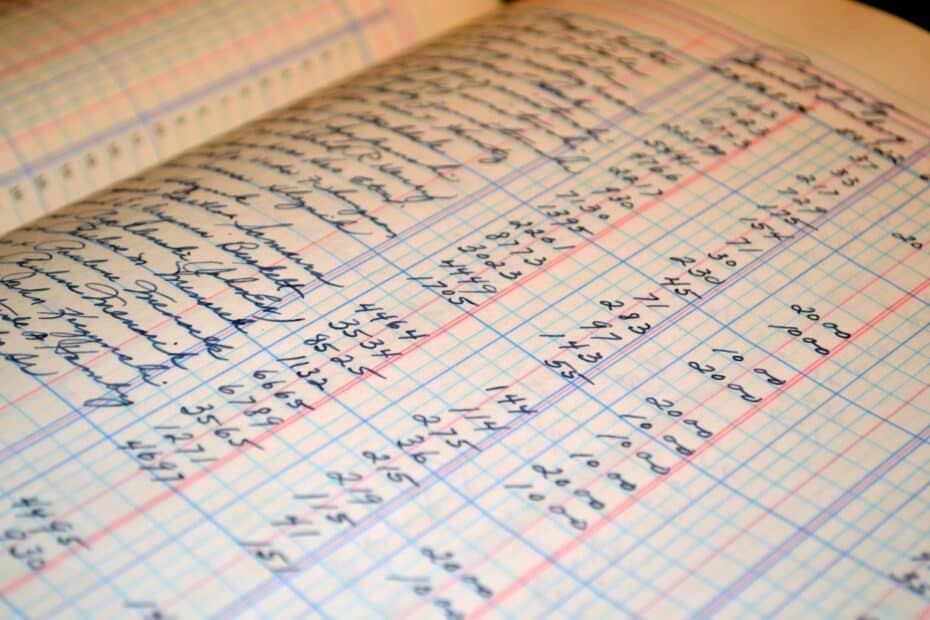

Before we dive into how to maintain a rent ledger, we should take a look at some examples. Check out a few good options that we like (here and here). Or you can buy one on Amazon if you prefer.

What Is a Rent Ledger?

A rent ledger is a tool used by landlords to document information about a rental unit including the tenant’s name, unit address and number, lease information, security deposit, and payment history. This information can be used by a landlord to quickly estimate future income and find any payment issues. Rent ledgers can also be useful for prospective tenants to document solid payment history.

While rent ledgers are primarily a tool for landlords, they can also provide benefits to tenants, banks, and prospective investors. The document serves as proof of payment history for each tenant, so it can be used in numerous ways. A tenant may ask for a copy of the rent ledger to show prospective landlords they have a good payment history. Or an investor can use the rent ledgers of a property to evaluate the rental income and understand the duration of existing leases.

Let’s take a look at what should be included in a rent ledger and then dig deeper into how it is used.

What Should Be Included In A Rent Ledger

A rent ledger is intended primarily to show information about each unit and tenant as well as the payment history of the tenant. With a good rent ledger, you should quickly know the current state of the lease and payments for any tenant.

The following information is vital to the effectiveness of a rent ledger. You should maintain one ledger per unit.

- Tenant’s name

- Tenant’s contact information

- Address of the property including tenant unit number

- Tenant move-in date

- Lease expiration date

- Security deposit paid

- Monthly rent amount

- Any additional monthly rent/fees (pet fees, parking fees, utilities, late payment fees, etc)

- Date and amount of rent due (entered when it is due)

- Date and amount of rent paid (entered when it is paid)

How Is a Rent Ledger Used?

Rent ledgers can be used in different ways. The main usage is for landlords to keep track of the lease and payments for each unit. But rent ledgers have more purposes. Here are just a few additional ways different parties use rent ledgers.

- Landlord — The primary users of rent ledgers. Landlords use rent ledgers to track the details of each lease and the dues and payments for each unit. Landlords also see contact information for each unit so they can quickly connect with tenants if some payment issue arises.

- Investor — If you’re looking to purchase a rental property, the collection of rent ledgers can help you put together a picture of the current and future income of the property. They can also help you identify if there are any problematic tenants that you will need to work with.

- Bank — Banks use rent ledgers in the same way as investors – to understand the income of a property. If you are looking to purchase a new rental property or refinance an existing property, the bank will want to know the net operating income of the property. The bank uses income information to determine the value of the loan they are willing to provide. This is especially true for multifamily properties.

- Tenant — An tenant may ask for a copy of their rent ledger when searching for a new home to rent. They can use the rent ledger to show potential landlords they are in good standing with their current landlord and that they have a solid history of paying rent. A landlord has no obligation to share the rent ledger, however some may be willing to.

How To Fill Out A Rent Ledger

Rent ledgers are evolving documents. You will create a new rent ledger for every unit when a tenant moves in and keep it updated every month to show how much you charged your tenant and when it was paid. Each rent ledger will live until the tenant moves out and close any remaining balance.

In the sections below, we will walk through what you need to enter in the rent ledger at different times throughout its life.

Ready? Let’s do this.

What To Enter When Signing A Lease

Every time you sign a new lease with a new tenant, you should create a rent ledger. At this point, most of the information required is just about the unit, tenant, and lease details. The only financial information you need to enter at this point is any security deposit and any prorated first month’s rent.

Here’s a list of what should be included in the rent ledger when you sign a new lease with a new tenant.

- Tenant’s name and contact information

- Unit address (and number if applicable)

- Move-in and lease expiration dates

- Agreed upon rent rate

- Any security deposit you collected

- Prorated first month’s rent

What To Enter Monthly

After you create the rent ledger with the information above, you need to maintain it monthly. Typically you have just a few transactions per month with each tenant, and most are at the beginning of the month. This can get more complicated if you charge various fees or include utility buybacks.

Typically you will visit the rent ledger twice per month to enter the following information.

- Rents/fees/utilities due should be entered before the start of each month so you can notify the tenant of their monthly charges. If you are including utility buybacks, you will need to collect your utility bills and appropriate the proper amounts to the rental unit.

- Paid rent should be entered when it is received so you can balance the account and assess any late payment fees.

What To Enter At The End Of A Lease

When a tenant moves out, you will close the rent ledger. At this point, the rent ledger should include any prorated last month’s rent along with final utility payments. You will also transfer any refundable security deposit into the ledger in preparation for closing.

After your tenant moves out, you will perform a final inspection of the unit and assess any charges. Place these on the rental ledger as well.

Once you have finished the inspection, you are ready to close the rent ledger. Because the security deposit was added to the rent ledger, you probably have a positive balance. Return the remaining balance to the tenant. If the remaining balance is negative, then you should send the tenant a bill. After the tenant pays the final bill, enter it into the rent ledger.

At this point, the rent ledger should show a zero balance.

Best Practices For Maintaining A Rent Ledger

Maintaining a rent ledger is not difficult. However, you can find yourself with some questions when using the ledger. To avoid any issues, you should follow these best practices.

- Enter transactions in a timely manner — Entering transactions into the ledger when they are received prevents you from having to dig through a bunch of paperwork and receipts. In the worst case, you may lose the paperwork and have to do additional research to determine the details of the transaction.

- Reconcile your rent ledger — You rent ledger should match your bank account, bills, and other accounts. You shoud cross-check and confirm the details on your rent legder with this information. This will prevent you from billing an incorrect amount to your tenant.

- Keep tenant information up-to-date — Over the course of the lease, your tenant may change phone numbers or email addresses. Update this information when you receive it so you know how to contact the tenant. Additionally, when the tenant moves out, you should update the rent ledger with their new address so you can send the final refund or bill.

Conclusion

Maintaining your rent ledgers doesn’t have to be a difficult process, and the value in sound record keeping is worth the effort. With consistently updated rent ledgers, you have quick and easy access to vital information about the payment status and history of each tenant.

Do you have any more tips for maintaining your rent ledger? Let us know.